Designing a Custom CRM with Role-Based Permissions and Google Ads Funnel Integration for a High-Volume Mortgage Broker

Case Study: Custom CRM Development for Mortgage Broker Lead Management

Client: Confidential (Independent Mortgage Brokerage)

Industry: Mortgage Lending & Lead Generation

Service: Custom CRM Development, Funnel Integration, Role-Based Access Control

Technologies: React, Node.js, SQL, Google Ads, Web Forms, Email Automation

The Challenge

A growing mortgage broker reached out to Owners Media with a common challenge: they were spending heavily on Google Ads to generate leads, but lacked a structured system to track, assign, and follow up with borrowers efficiently.

They needed a custom-built CRM that would seamlessly capture lead data from their intake funnel and help internal users manage each applicant’s progress — from inquiry to pre-qualification.

The CRM had to support different levels of access and functionality based on the user’s role: Admins, Supervisors, and Associates — each with clearly defined permissions and responsibilities.

Our Solution

Owners Media designed and built a fully customized CRM platform integrated with the client’s existing marketing funnel. This allowed borrowers to flow directly from Google Ads to a landing page, through an intake form, and into a dynamic, role-based lead management system.

1. Marketing Funnel Integration

We connected the entire lead journey:

- Google Ads directed borrowers to a dedicated landing page

- The page included a branded intake form to collect borrower details (location, income, credit score, loan goals, etc.)

- Upon submission, data flowed directly into the CRM — eliminating the need for manual data entry

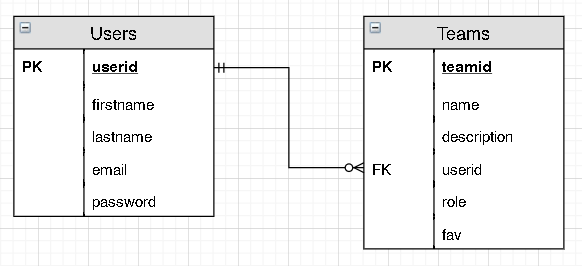

2. Custom CRM With Role-Based Permissions

We built a clean, user-friendly CRM with three key permission tiers:

- Admin: Full system access. Able to create/edit users, monitor all borrower records, and assign permissions.

- Supervisor: Can view all incoming applications and assign them to individual Associates. Also able to leave internal notes and update borrower status.

- Associate: Has access only to borrower records assigned to them. Can update applicant progress and view internal notes.

This structure gave the brokerage clear control and accountability at every level of the team.

3. Collaborative Notes and Status Tracking

Both Admins and Supervisors were able to:

- Leave timestamped internal notes on any borrower profile

- Update status markers (e.g., New Lead, Contacted, Pre-Qualified, In Process)

- Track touchpoints across the entire borrower journey

This helped ensure that no lead fell through the cracks, and that team members had a clear view of communication history and next steps.

The Results

- A centralized CRM that captured and organized 100% of leads from the marketing funnel

- Faster lead response time due to real-time intake integration

- Clear visibility and accountability through structured user roles

- Improved collaboration between team members via internal notes and status logs

- A scalable system ready to support future growth in both users and lead volume

Conclusion

This project demonstrates how Owners Media delivers purpose-built digital infrastructure for client-specific workflows. By combining front-end lead capture with back-end CRM logic, we helped this mortgage broker turn their Google Ads investment into a trackable, manageable, and scalable borrower funnel — all inside a system designed exclusively for their team structure.