Building an AI-Enabled “Universal Housing Grants Application” for Mortgage Lenders to Pre-Qualify Borrowers for Assistance Programs Nationwide

Case Study: Developing a Universal Housing Grants Application for Nationwide Lenders

Client: Confidential (National Mortgage Lending Network)

Industry: Mortgage & Homebuyer Assistance

Service: Custom Web Application Development, AI Integration, Automated Workflows

Technologies: React, Python, SQL, AI-assisted Form Logic, Email Automation

The Challenge

Our client, a national mortgage lending network, needed a smarter, faster way to help Mortgage Loan Officers (MLOs) identify which down payment and housing assistance programs their borrowers might qualify for — without forcing the borrower to dig through multiple state and local agency sites.

The client envisioned a universal application tool: a single, intelligent form that would pre-qualify homebuyers for over 2,000 down payment assistance (DPA) programs across the country, while minimizing human error and manual work.

Our Solution

Owners Media developed a custom web-based application that functions as a centralized, AI-enabled screening tool. It allows Mortgage Loan Officers to pre-qualify borrowers in real time and confidently match them with relevant assistance programs.

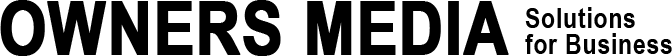

1. Smart Form with Real-Time Program Filtering

We built a dynamic web form that collects relevant borrower information — including income, household size, location, credit score, and veteran status — and instantly filters through a nationwide database of DPA programs. The form provides eligibility results in real time, removing guesswork and streamlining the qualification process.

2. AI-Powered User Assistance

To enhance usability and accuracy, we integrated AI-driven form assistance that helps users answer questions, auto-detects formatting issues, and reduces common input errors — especially around address formats, income fields, and document uploads.

This helped both borrowers and loan officers save time while improving data quality.

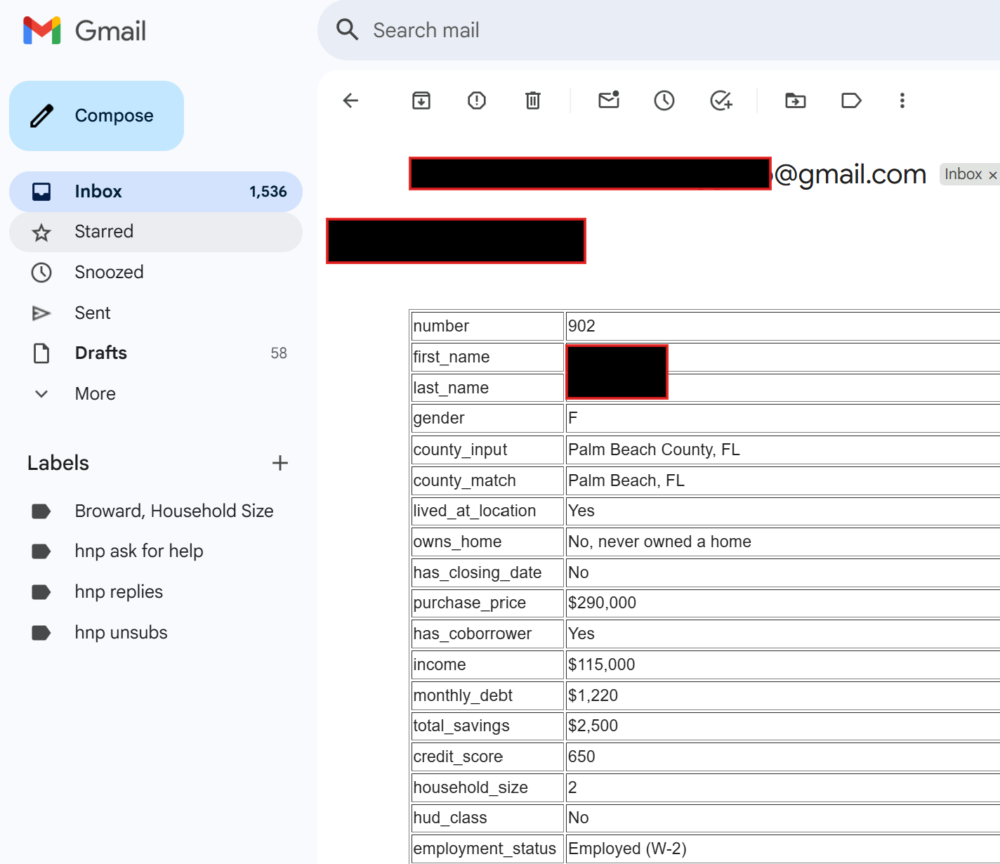

3. Automated Email Notifications

Upon submission, the system automatically sends confirmation emails to both the borrower and the assigned Loan Officer. These emails include:

- A summary of the submitted application

- A list of potential matching programs (when available)

- Next steps in the lending and assistance process

This feature eliminated the need for manual follow-up and ensured timely communication across the board.

4. Program Database Integration

We built and maintained a structured SQL database of over 2,000 active down payment assistance programs — complete with detailed eligibility criteria, geographic targeting, income limits, and funding details. The smart form queried this database in real time, providing accurate results based on the borrower’s profile.

The Results

- Enabled faster and more accurate borrower screening across all 50 states

- Empowered Mortgage Loan Officers to confidently offer assistance insights at the start of the lending process

- Reduced application input errors by over 40% through AI-assisted form logic

- Delivered instant, automated communication between loan officers and borrowers

- Created a scalable foundation for expanding assistance tools to other areas of lending

Conclusion

This project illustrates Owners Media’s ability to blend AI, automation, and custom development to create intelligent tools that solve real business problems. By building the Universal Housing Grants Application, we helped our client deliver value at the critical intersection of lending and housing assistance — making the homebuying journey more accessible for thousands of borrowers.